In the recent publication by the American Immigration Lawyers Association (AILA) on “Understanding the Individual Taxpayer Identification Number (ITIN)”, it elucidates the significance of ITINs issued by the IRS for individuals ineligible for a Social Security Number (SSN) yet require a U.S. taxpayer identification number.

Particularly crucial for foreign nationals navigating U.S. immigration processes, ITINs facilitate tax compliance and are essential for various financial activities, such as opening a U.S. bank account.

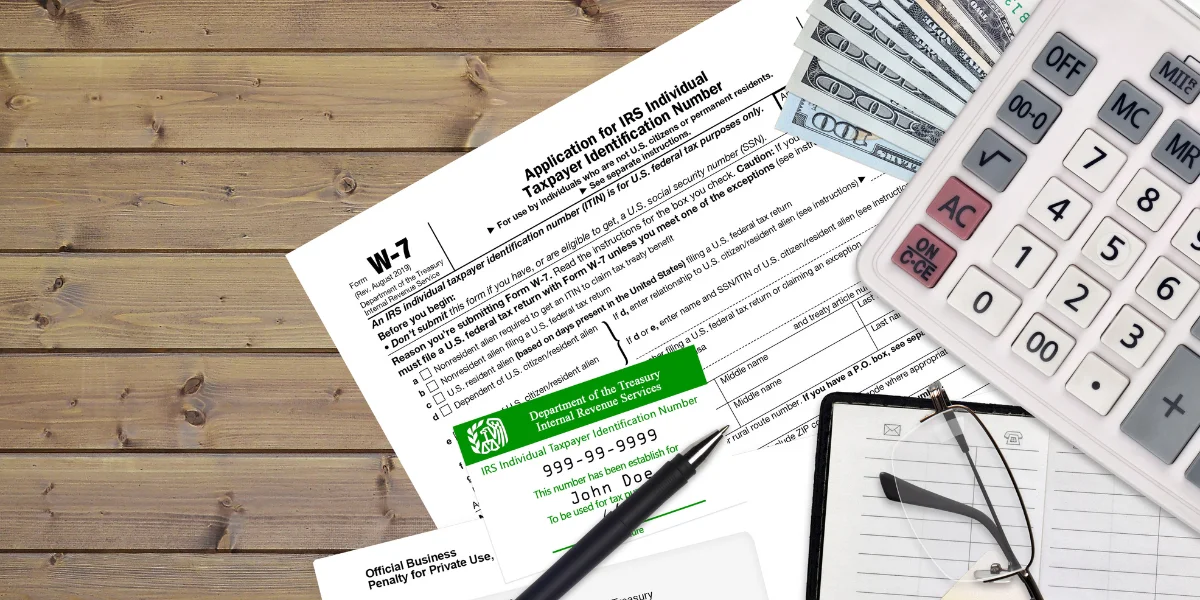

However, the article warns against ITIN-related scams, clarifying that ITINs do not authorize employment, Social Security benefits, or confer legal immigration status. The eligibility criteria for obtaining an ITIN are detailed, encompassing nonresident and resident foreign individuals, dependents, and those claiming treaty benefits. Application procedures, including Form W-7 submission either by mail, in person, or through IRS-certified agents, are outlined.

Furthermore, the article underscores the expiration of ITINs after three consecutive years of non-use and directs readers to the IRS website or their legal counsel for further guidance. Lastly, it emphasizes that the information provided serves as general guidance and recommends consulting a licensed attorney for specific legal advice.